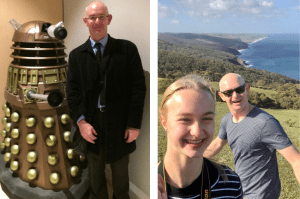

Q&A with our R&D Tax Incentive and Grants Specialist, John Nixon

There aren’t many people who know the R&D Tax Incentive like John Nixon does. Over the last 15+ years, he’s worked on it from every angle (applicant, government and professional services).

This, combined with his interest in grants, is excellent news for startups and growing SMEs that need to keep the cash heading in the right direction (in).

We’re pretty happy to have this self-confessed maths, science and tech geek on our team, even though his survival skills are questionable. That will make sense below!

1. Just quickly, what’s your role here at Standard Ledger?

I’m the R&D Tax Incentive and Grants Specialist. That means I’ll be servicing Standard Ledger’s R&D tax clients nationally and leading the grants side of things, too.

I’m also here to help startups and growing SMEs in my local area (South Australia) with access to funding.

2. Why does it fire you up?

Coming out of 10+ years at a ‘big four’ professional services firm, what most excites me is the autonomy this role will allow me to exercise in the local and national market.

Don’t get me wrong – I love ploughing through R&D tax work as well as the diversity there is in grants – but working even more closely, in that context, with startup and early-stage companies will be awesome.

3. If you were a startup, what would your elevator pitch be?

People say that I care and I actually do care; they also trust my judgement and think I am good at what I do – these things matter to me. I like to build and solve the puzzle, and I have an analytical mind while still maintaining a broad view.

(Editor’s note: Not quite an elevator pitch but it works!)

4. Tell us a bit about yourself

I grew up in Adelaide. I am a major maths, science and tech geek with an artistic side. My wife is a self-employed architect and interior designer (who I am the IT and QA guy for), and our 16-year-old daughter is a national competition level dancer, who we seem to spend a lot of time and money enabling!

We live (and work) in an old house with a garden, both of which take some looking after. There is some time left for movies, books, good food and travel (mainly around dance competitions). We all love a good bushwalk, and getting out into nature whenever we can.

5. What’s your professional background?

In reverse order:

- 10+ years at KPMG in the Accelerating Business growth team, specialising in grants and R&D incentives

- 3 years at AusIndustry (federal government department and R&D Tax regulator) in the R&D Tax & Grants team

- 6.5 years as an R&D Manager at United Water International (the then Adelaide water utility) supervising post-graduate students/projects on modelling, optimisation, and artificial intelligence techniques applied to water resources, treatment and networks problems

- A series of post-doctoral research positions at SA universities, where I used PhD level Applied Mathematics for environmental modelling, schedule optimisation, and cognitive neuroscience (for example)

6. How can you help founders and business owners?

By planning and implementing strategies to access the many grants and incentives available from government (federal, state and local), and in some cases from NGO sources as well.

This could include:

- Maximising the benefits and minimising the risks of R&D Tax Incentive claims

- Identifying and applying for grant opportunities for projects in the pipeline

- Enabling access to non-cash assistance that’s available, especially in the post pandemic economic response realm

7. Finally, the big question…

You’re stuck on a desert island. What three foods would you take for the rest of your life?

1. Absolutely some coffee (is that a food?). I admit to an addiction there

2. Some fresh, crisp salad leaves are hard to beat

3. I’d definitely need some mushrooms as well

Oh dear, I think I’ll starve!

I think you really mean something like: Indian, Thai, Italian?

8. How do people get in touch with you?

I’m always keen to hear from startup founders and business owners. Here’s my email. I’d love to hear about your business and how I can help.

………………………………………………

You can also find out more about our R&D Tax Incentive and Grants services.

Events coming up

Expanding to the UK: Startup Finance and Legal Basics

More articles

- Scaling Up, Expanding/Exiting

- Early Stage, Scaling Up

- Expanding/Exiting