Director Identification Numbers

What is a Director Identification Number?

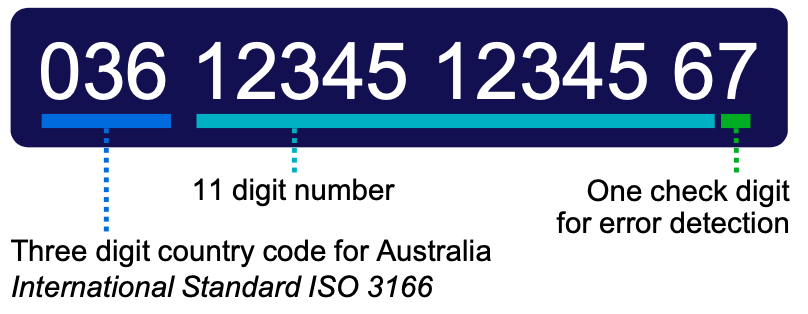

A Director Identification Number (DIN) is a unique 15-digit number that you need if you’re a director of a company, registered Australian body, registered foreign company or Aboriginal and Torres Strait Islander corporation.

Once you have a DIN, you’ll keep it forever and use it for all company directorships.

Here’s an example of a DIN.

Why do you need a DIN?

All directors are required to have a DIN. Penalties of up to $13,200 can apply if you don’t have one by the relevant deadline (more below).

DINs were introduced to reduce director fraud and dodgy behaviour such as companies installing ‘dummy directors’, who don’t know about their positions and are used to take the fall if things go badly.

When do you need to have a DIN by?

That depends on when you became a director, for the first time. Here are the details:

- If you became a director any time from 5 April 2022, you were required to get a DIN before being appointed a director

- If you first became a director between 1 November 2021 and 4 April 2022, you were required to get a DIN within 28 days of being appointed

- If you first became a director on or before 31 October 2021: You need to have a DIN by 30 November 2022 – apply now

What if you don’t get a DIN in time?

If you’re already supposed to have a DIN but you haven’t, there are a few options including speaking to your accountant or getting in touch with the ATO.

If you became a director for the first time on or before 31 October 2021, you still have time to apply for a DIN (the deadline is 30 November 2022). Apply here or you can also apply for an extension.

Remember, ASIC fines of up to $13,200 can apply if you don’t have a DIN when required.

How do you apply for a DIN?

Your accountant can help you decide if you need to apply for a DIN but can’t apply on your behalf – you have to do it yourself.

The ATO has put together a video about how to apply. Here’s a quick summary of what it involves.

First up, gather your supporting documents to:

- Prove your tax file number (TFN)

- Prove your residential address held by the ATO

- Answer questions about your ATO record, which can be any two of your latest: Notice of Assessment, PAYG payment summary, dividends statement, Centrelink payment summary, bank account details, and superannuation account details

Second, make sure you have a myGovID (this is different from your personal myGov account). If you don’t have one yet, create one using your smartphone and Australian identity documents. You can also use your myGovID to access any of your company business records.

Lastly, head to the Australian Business Registry Services website to:

- Verify yourself using your myGovID

- Apply for for your Director Identification Number (DIN)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Thanks to Karolina Grabowska from Pexels for the photo.

Events coming up

We're not running any events at the moment.

More articles

- Early Stage, Scaling Up

- Early Stage, Scaling Up

- Scaling Up, Expanding/Exiting